Let’s face it, we all see headlines from time to time and it’s only human that they impact our mood. But with investing, our emotions can really trip us up.

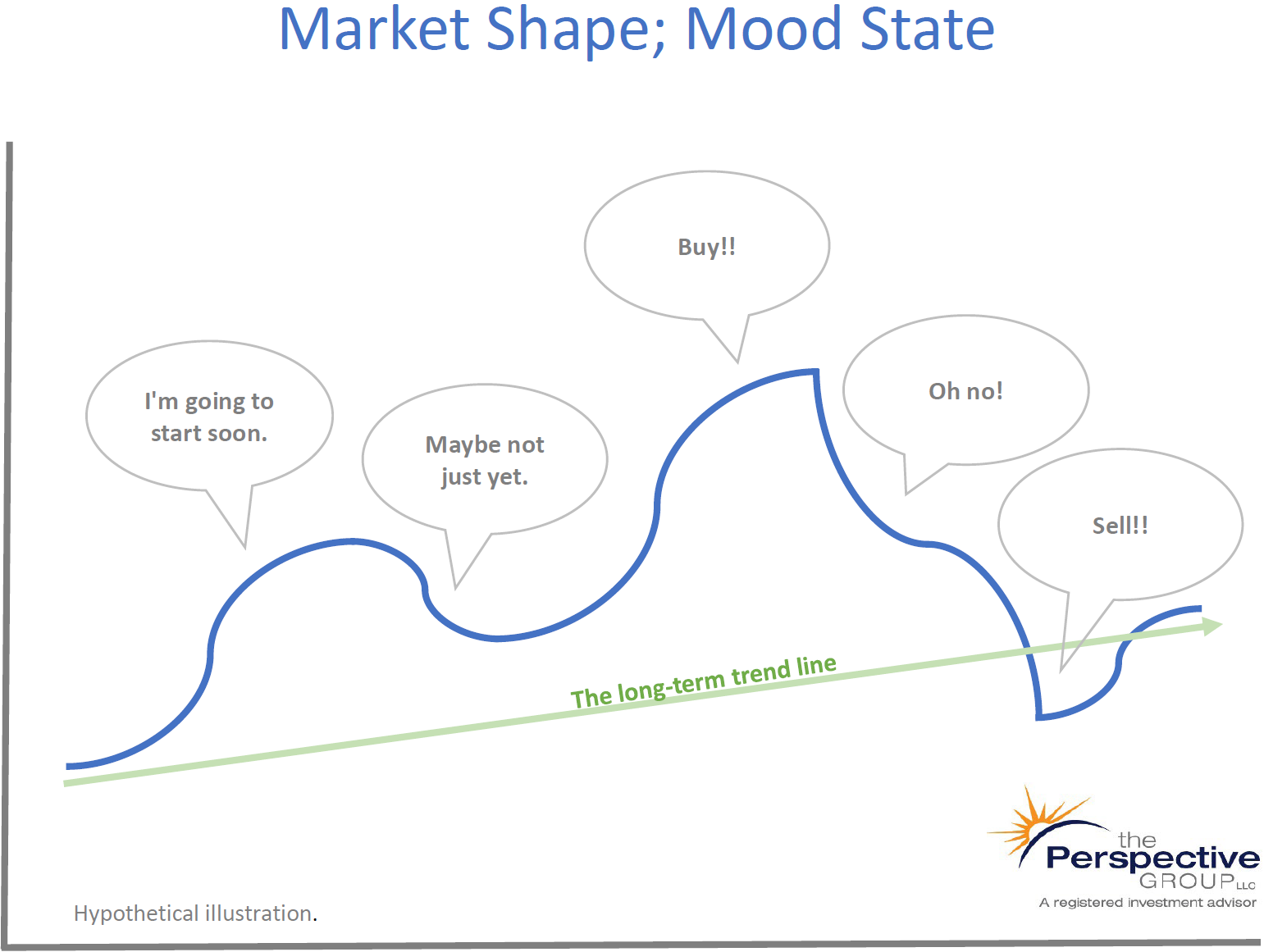

Most people who are going to invest do it in one of two ways: They either do it themselves or they work with a professional. And regardless of the path, everyone can relate to the following graph:

Whether it’s a single stock or the market in general, stock values will move in waves that can rise and fall and wreak havoc on your human psyche. Consider the hypothetical wave on this graph and imagine how you might feel as the market, in whatever asset you are following, moves up. It’s human nature to think, “I want some!” That also happens to be a favorite line of my nine-year old son when he sees me hand something to his five-year old brother. Apparently, these feelings are with us from an early age and carry on as we mature. I want some! So we’re drawn to invest as the market moves up.

As the wave moves higher, you start seeing and hearing reinforcements. That may come in the form of headlines, co-workers, or maybe even from a friend – or, even more emotionally alerting, in a peer-group setting. You’ve probably been in a situation where you heard a comment like, “Wow, I’ve made a lot on (pick your asset)! Are you buying some too?” Many people at this point will start to invest – the “Buy!!” moment.

Almost inevitably, the asset will start to decline when emotion meets reality. In our illustration, this is where many feel that “Oh no!” moment. But, wait, it can get worse – because guess what emotion gets our attention even more than “I want some”? You guessed it, FEAR! Now, all of a sudden we’re in fight or flight mode and our hormones are kicking in and short-circuiting our more rational self. “Sell!!” Ahh – relief. “At least it’s not going to decline any more. I ‘stopped the bleeding.’” And then, like a twisted trick, the price inevitably starts going up again…and perhaps the entire cycle repeats.

I’d like to think I’ve never fallen into this trap myself. But, such is how we learn. As they say, experience is the best teacher.

One way to potentially enjoy the experience of investing is to work with a professional who has learned (ideally through personal experience, academic training, and work experience) how to help you navigate investing and tries to help you increase the odds of making the most of your money.

A professional can offer several useful strategies to help an investor avoid the emotional roller-coaster ride depicted in the graph. One of these is investing a set amount on a consistent basis (the process known as “dollar-cost averaging.”). This removes the “When should I invest?” decision.

Another strategy is to invest in a diversified portfolio. While this portfolio can still follow a wave-pattern, it provides an opportunity to increase the potential that the wave (and your experience) will be less wild.

If you’d like to visit about how we would approach investing with you, please contact us.

Important Disclosures

All illustrations are hypothetical examples and are not representative of any specific situation.

Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in declining markets.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes.

Investing involves risks including possible loss of principal.

Advisory services offered through The Perspective Group, LLC, A registered investment advisor, and separate entity from, LPL Financial.

Professionals associated with The Perspective Group may be either (1) registered representatives with, and securities offered through LPL Financial, Member FINRA/SIPC, and offer advisory services through The Perspective Group, a registered investment advisor; or (2) solely tax professionals of The Perspective Group, and not affiliated with LPL Financial. Tax related services offered through The Perspective Group, a separate legal entity, and not affiliated with LPL Financial. LPL Financial does not offer tax advice or Tax related services.

Securities offered through LPL Financial. Member FINRA/SIPC.