Our Philosophy

Our financial-planning philosophy is that before we go, we need to know where we are going toward. It is based on the faith that if we work the plan, we will come closer to our goals than if we don’t. We keep the faith in our plan even when short-term distractions come up.

To us, financial planning is a sophisticated term for connecting a goal (or goals) with today. We believe the planning process should be an enjoyable and rewarding process. It is rewarding because it brings clarity to life. We believe it is through the personal process of developing a holistic and comprehensive financial plan that one can pursue comfort, peace, and ultimately, simplicity. In time, through this ongoing fluid process we believe that as you are authentic with us about what really matters to you and that you work with us with drive and determination, that you will likely enjoy greater peace, joy and fulfillment.

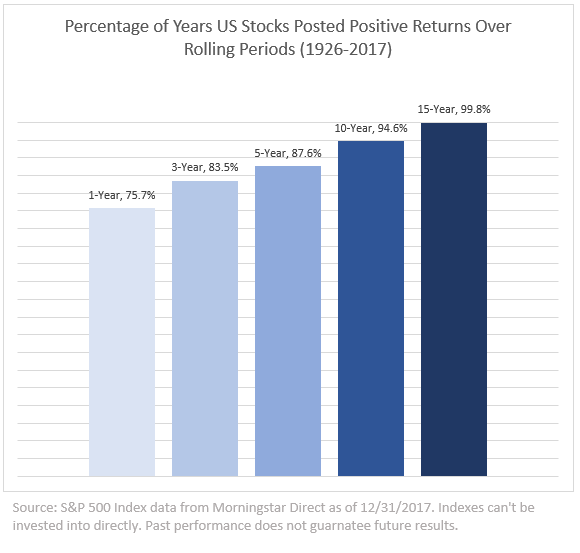

Our portfolio philosophy is rooted in the belief that it is essential to have time in the market. We believe that over the long term, owning is better than loaning and that nothing beats cash for the short term. We believe that owning outstanding businesses (through shares of stock) is an investment for potential long-term wealth creation and preservation. Loaning to businesses (or governments) through bonds may be best for those who seek to create the most income today. Cash is our preferred investment for short-term holdings.

Retired financial advisor and author Nick Murray shared that, “Time in the market, as opposed to timing the market, is not a way of capturing the long-term returns of equities; it is the only practicable way. You have to stay in it to win it.”

Bottom line, you can say we are market “time-in-ers.”

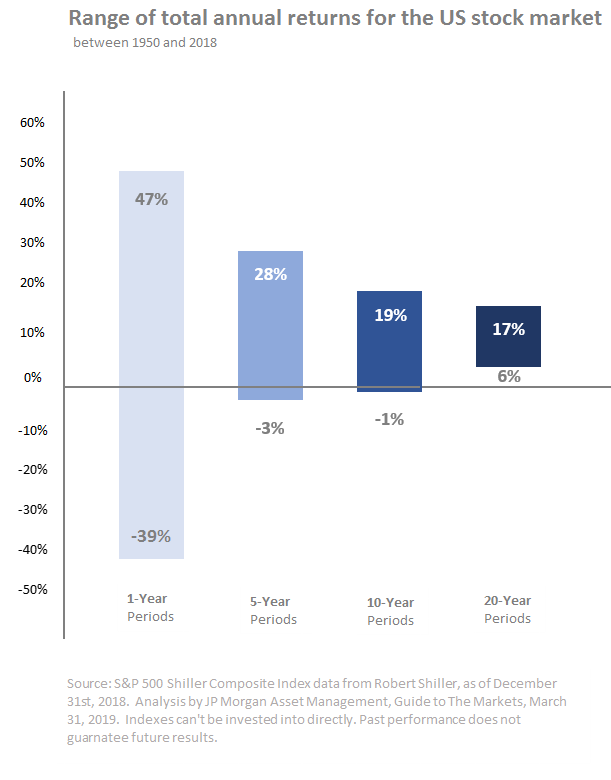

Please consider this graph:

What this graph shows and conveys is that investing in stocks may be best for long-term growth, but terrible for short-term predictability.

Our philosophy includes a natural bias toward optimism. We have an inherited belief system that traces its roots back to 1830 when the historian Thomas Babington Macaulay posed this classic rhetorical question: “On what principal is it, that when we see nothing but improvement behind us, we are to expect nothing but deterioration before us?” We wholeheartedly agree.

On that note, we do not advocate “timing” the market because that includes time out of the market. We didn’t like time-outs in school and we don’t like them now. We are time-in-ers. We believe that the “Sell in May…” talk, or the attempt at guessing at the next correction, bear-market, or recession is counterproductive to the goal of wealth building.

The legendary investor Peter Lynch concluded that, “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.”

We fully understand that declines of 10% or more in stock prices, which is officially called a correction, tend to happen about once every three years. We further understand that declines of 20%, or more, seem to come along about every five to seven years. Our advice? Don’t fear these – just treat them as you would a blizzard in the winter. You get through it and you know that in time it will pass (and kill off the bugs).

Since price and value are always inversely correlated, we welcome the lower prices as potentially superior investing opportunities.

Our philosophy leads us to this portfolio design process

It begins with our attentively listening to your investment preferences. We ask key questions to help us clearly identify these. Our goal is to create the most effective portfolio we can, based on your preferences and reflecting your values and situation. We recognize that your portfolio will be tailored to your goals and realities. Next, we work to employ strategies in pursuit of:

- Efficient holdings with no, or low, internal expenses

- Dollar cost averaging with contributions or reinvested dividends

- Tax-efficient portfolios for non-retirement accounts

- Low portfolio turnover

Process. Our process follows a “buy and monitor” philosophy. We do not trade daily; rather, we trade as necessary. Markets, business cycles, individual companies, and your personal situation will change over time — and we stand ready to act proactively on your behalf.

Sustainability. The concept that is embedded in our values is reflected in our portfolios. We design portfolios that reflect both your and our desire for sustainability– sustainability with the resources and wealth you have, and sustainability in the current world economy. Please visit with us more about how we connect the dots.

Benjamin Graham, the father of value investing and mentor to Warren Buffett said that “Price is a creature of the market’s mood. In booms, it is set by the greediest buyer; in busts by the most fearful seller. A stock’s value, in contrast, is enduring.” Graham, like Buffett, and like us, takes a long-term perspective.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against a loss in declining markets.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.

The payment of dividends is not guaranteed. Companies may reduce or eliminate the payment of dividends at any given time.