When I was in college, during my first accounting class, Professor Tim Shaftel, CPA, used a break in class to have a sidebar conversation. Prior to this, we were all taking notes on how to appropriately “debit and credit” something known as “T” accounts. For me at least, this wasn’t too exciting. But at the age of 20, I was about to wake up to the concept of compound earnings (a.k.a compound interest).

Professor Shaftel applied a jolt of electricity through me with his five-minute detour. He put up a slide that showed what happens when you invest from an early age and keep doing it every year. He made the assumption that you would earn 8% on your investment, and he ignored the impact of taxes. But what he revealed to me and the class that day changed my life. He used a simple table illustration to show how an investment of as little as $2,000 a year could turn into a million dollars after fifty years – figures I still remember to this day.

When should you, your kids, or your students start investing? Now! Let me build on the concept above and illustrate the difference between starting now and starting a bit later. (We won’t consider the third camp – those who never start.)

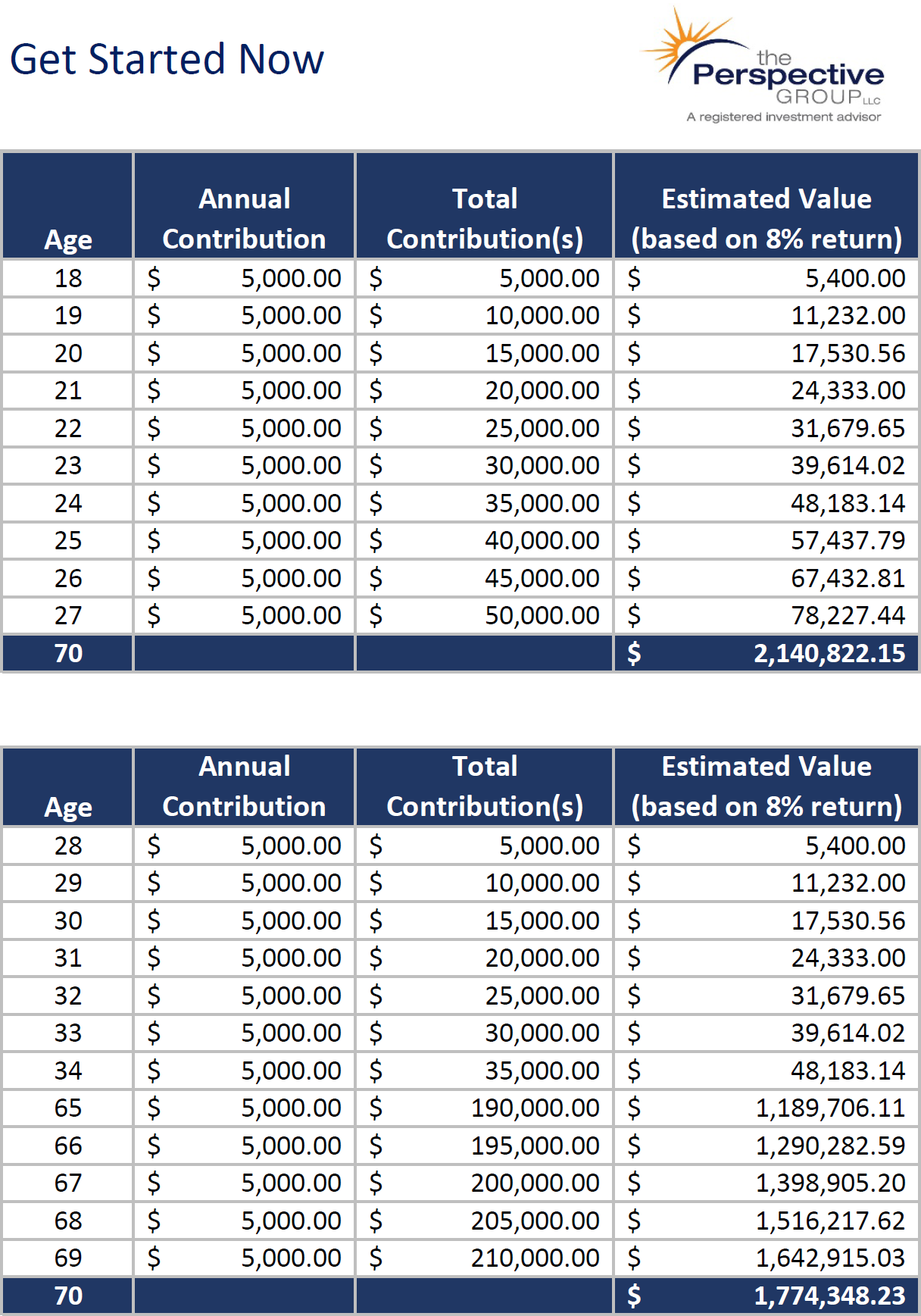

The following table illustrates what a consistent annual investment of $5,000 may become, assuming an 8% rate of return and ignoring taxes (for the sake of simplicity):

In the first table we see how compound earnings really start to add up. The person in this example contributed $5,000 a year from the age of 18 through 27 before stopping, for a total contribution of $50,000. Then, let compound earnings go to work and at the age of 70, she would have about $2.1 million! If this illustration gave you a bit of a zing (or jolt as it did me), now you know how I felt sitting there in the lecture. Needless to say, I had a hard time mentally returning to the class topic that day.

Contrast the first example with an individual who started saving at the age of 28 and made a habit of investing $5,000 per year for the next 42 years, until reaching age 70. That commitment worked well, and her investment reached a value of $1.77 million! That’s impressive – but you’ll also notice that she contributed $210,000, whereas the first person contributed “only” $50,000. Yes, the second person contributed more than four times as much…and ended up with 17% less. Compound interest (or compound earnings) rewards those who invest the longest.

If you’re wondering when is the right time to start investing, or when to encourage your children, grandchildren, friend, or student to start – consider sharing what you learned about compound earnings.

As our founding father Benjamin Franklin said, “Money makes money. And the money that money makes, makes money.”

If you’d like to visit about how we would approach investing with you, please contact us.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes.

Investing involves risks including possible loss of principal.

Advisory services offered through The Perspective Group, LLC, A registered investment advisor, and separate entity from, LPL Financial.

Professionals associated with The Perspective Group may be either (1) registered representatives with, and securities offered through LPL Financial, Member FINRA/SIPC, and offer advisory services through The Perspective Group, a registered investment advisor; or (2) solely tax professionals of The Perspective Group, and not affiliated with LPL Financial. Tax related services offered through The Perspective Group, a separate legal entity, and not affiliated with LPL Financial. LPL Financial does not offer tax advice or Tax related services.

Securities offered through LPL Financial. Member FINRA/SIPC.